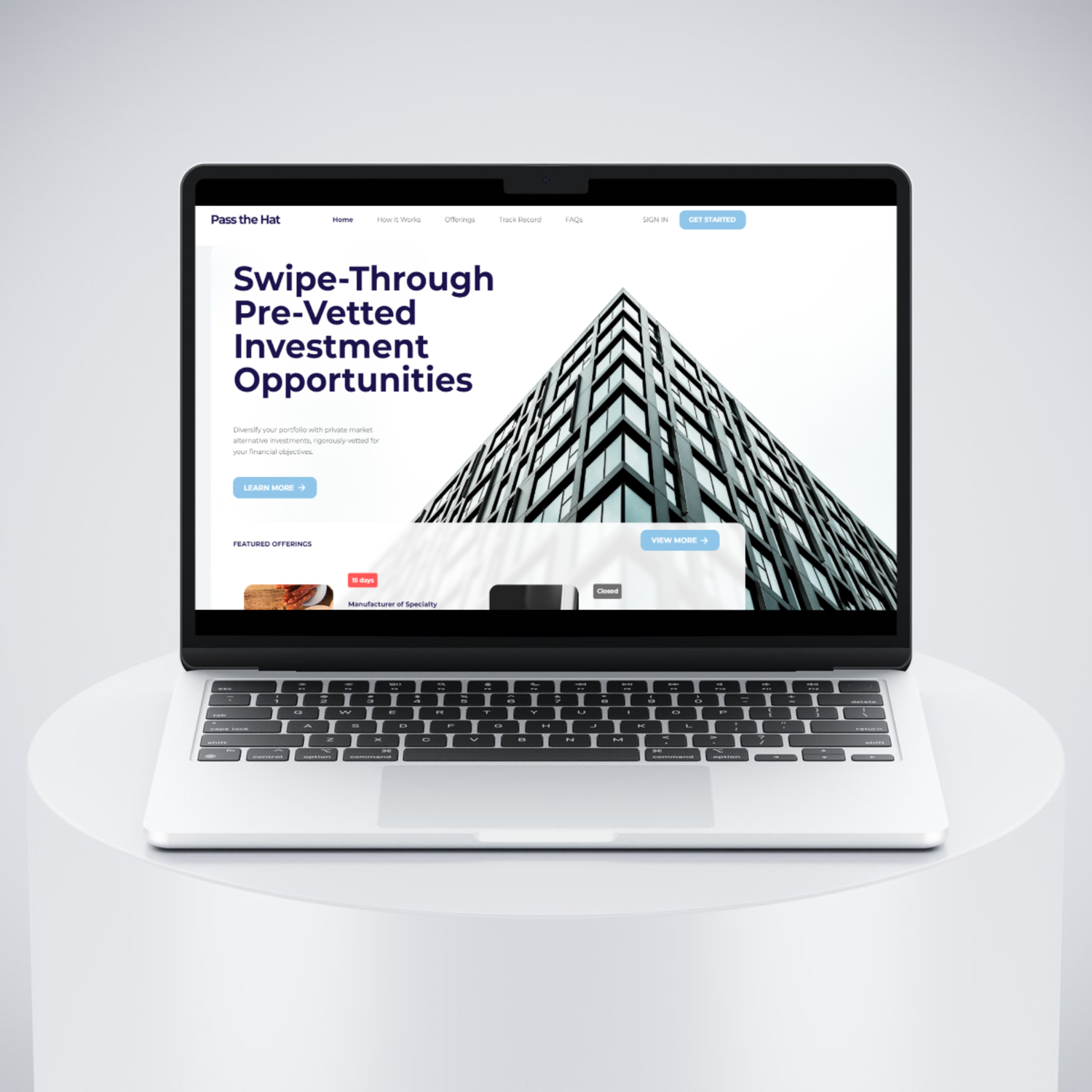

Borgman Capital Launches Retail Investor Platform Pass the Hat

Pass the Hat connects accredited U.S. investors to Borgman Capital’s private market investment opportunities.

Learn more at www.PasstheHat.com.

MILWAUKEE – (May 23, 2024) – Private investment firm Borgman Capital announced today its launch of Pass the Hat (www.PasstheHat.com) an online platform that provides accredited U.S. investors with access to alternative investment opportunities sponsored by the firm.

“Pass the Hat connects accredited U.S. investors to private market investment opportunities that were once only available to large institutional investors," said Sequoya Borgman, Founder and CEO of Borgman Capital. "Through the new platform, we eliminate barriers to quality alternative investments by making it easy for accredited high-net-worth individuals, family offices, endowments and foundations to invest and achieve portfolio diversification.”

Founded in 2017 in Milwaukee, Wisconsin, Borgman Capital primarily acquires successful companies with $10-$100 million of annual revenue. Borgman’s current portfolio spans industries including food, pet treats, manufacturing, chemical distribution and infrastructure. Borgman Capital’s portfolio also includes industrial and mixed-use real estate properties located in the Midwest.

The firm has completed 18 transactions to-date, with an investor network that includes high-net worth individuals, family offices, and other entities.

“Our success to-date would not be possible without the support of our entire network and those first investors who trusted us with their investment dollars. Pass the Hat is a new strategy to connect with investors, but our philosophy remains the same: relationship-focused, transparent, and to exceed investor expectations,” added Borgman.

Pass the Hat Quick Facts:

Pass the Hat showcases Borgman Capital’s pre-vetted private market investments in private equity and real estate.

Pass the Hat follows a private equity model where each investment vehicle owns control of an operating company or real estate property that is acquired rather than a passive or minority interest in a business.

Flexible model enables investors to pick and choose the investments that are right for their goals.

For most deals on the Pass the Hat, the minimum investment amount is $50,000.

Only accredited investors as defined by Rule 501 of Regulation D of the Securities Act of 1933 may invest. Accredited investor status is verified by a third-party partner.

Visit www.PasstheHat.com to learn more.

##

About Borgman Capital

Founded in 2017, Borgman Capital is a private investment firm focused on acquiring successful lower middle market businesses that are poised for growth, and real estate properties with untapped potential. The firm acquires companies with annual revenue between $10 and $100 million and EBITDA between $2 and $15 million. Our professionals work with business owners to explore deals in a fair, flexible, and creative manner. Borgman Capital is headquartered in Milwaukee with additional operations in the Twin Cities. Learn more at borgmancapital.com.

For more information:

Marit Harm

Marketing Manager, Borgman Capital

marit.harm@borgmancapital.com

Disclaimer: Pass the Hat is a website for informational purposes only and does not constitute an offer to sell any security. The website does not constitute a solicitation to buy any security in any jurisdiction where such solicitation would be unlawful. Investment opportunities available through Pass the Hat are speculative and involve substantial risk. You should not invest unless you can sustain the risk of loss of capital, including the risk of total loss of capital. Our efforts to vet investment opportunities may not reveal or highlight all relevant facts that are necessary or helpful and will not eliminate the substantial risk of loss for any investment opportunity. All investors should consider their individual factors in consultation with a professional advisor of their choosing when deciding if an investment is appropriate. Private placements are illiquid investments, in that they cannot be easily sold or exchanged for cash, and are intended for investors who do not need a liquid investment.Performance information presented on Pass the Hat has not been audited or verified by a third party. Nothing on the website should be interpreted to state or imply that past performance is an indication of future performance. All investments involve risk and are not guaranteed. By accessing Pass the Hat, users agree to be bound by its Terms and Conditions, Non-Disclosure Agreement, Privacy Policy, and any other policies posted on this website. Pass the Hat is only intended for accredited investors in the United States.